34+ deductible home mortgage interest

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Web Most homeowners can deduct all of their mortgage interest.

. Also if your mortgage balance is. In a 52-week span the lowest rate was 445 while the. Web Todays 30-year mortgage refinance rate falls --002.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web Home Mortgage Interest. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Lets start with the mortgage from 2016 with an average balance of. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Generally home interest is deductible on a Form 1040 Schedule A attachment if its. Web Todays average rate on a 30-year fixed-rate mortgage is 713 which is 004 higher than last week.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Web Important rules and exceptions. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

Web Tax Court Tightens Rules on Mortgage Interest Deduction. Were Ready to Help You Find the Right Mortgage. As a Community Bank We Strongly Believe in Providing Affordable Mortgage Solutions.

Web Line 10 Enter on line 10 mortgage interest and points reported to you on federal Form 1098 Mortgage Interest Statement. In 2005 Brother A purchased a home in Paradise Valley Arizona for 1525000. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

13 1987 your mortgage interest is fully tax deductible without limits. If you took out. Home mortgage interest limited If.

Ad Ready to Move from Renter to Homeowner. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. According to the IRS home mortgage interest is any interest you pay on a loan secured by your home main home or a second.

Web If youve closed on a mortgage on or after Jan. Compare offers from our partners side by side and find the perfect lender for you. Web Do you need to file the Deductible Home Mortgage Interest Worksheet.

Homeowners who bought houses before. Web Mortgages taken by single filers or married couple filing separately after October 13 1987 and before December 16 2017 qualify for a deduction up to. The average 30-year fixed-refinance rate is 712 percent down 2 basis points compared with a week ago.

Web If you took out your mortgage on or before Oct. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Here is a simplified example with two instead of three mortgages.

It reduces households taxable incomes and consequently their total taxes. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be.

Web Yes of course. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. If you are single or married and.

Mortgage Interest Deduction Rules Limits For 2023

Free 34 Printable Payroll Forms In Pdf Excel Ms Word

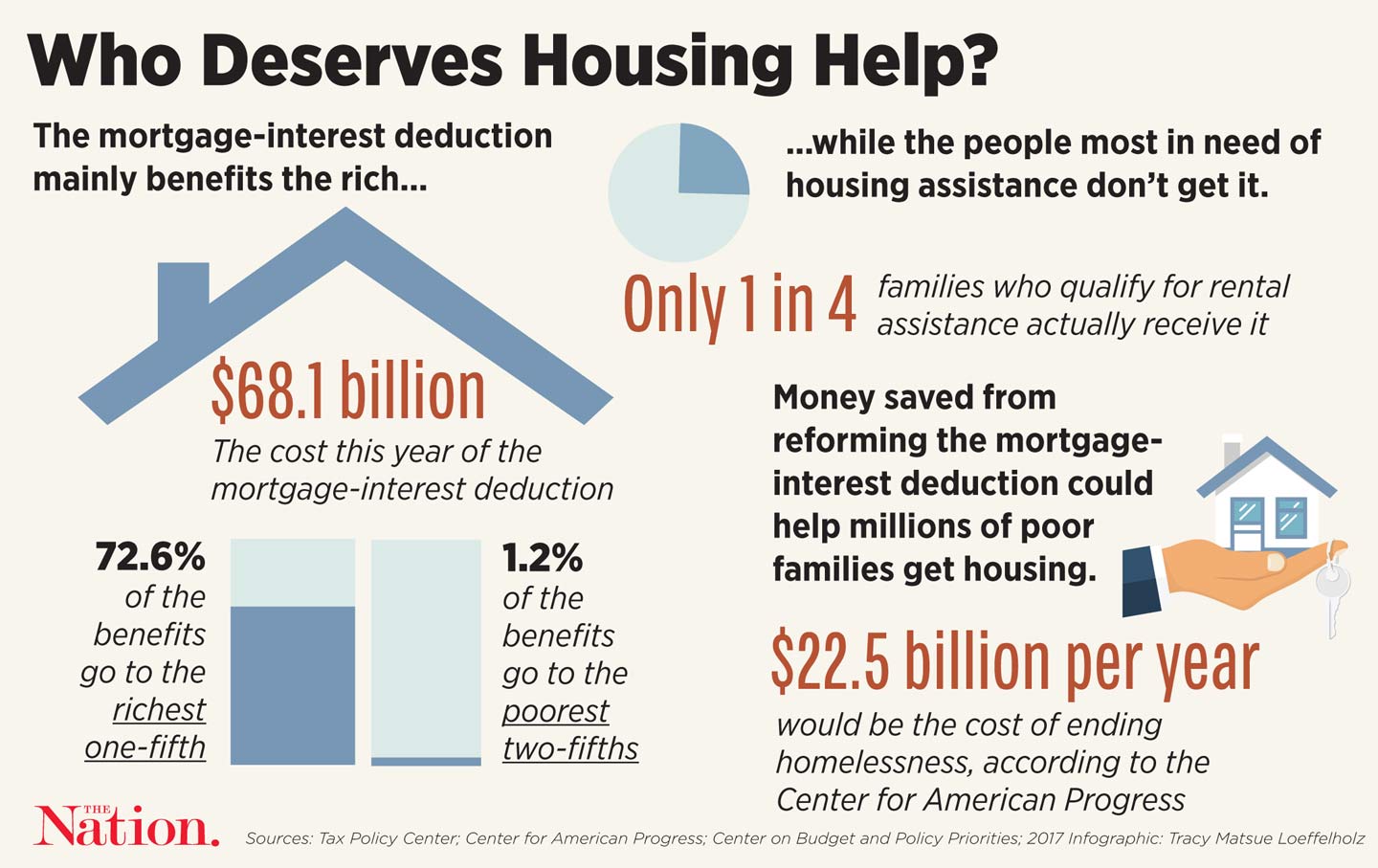

Race And Housing Series Mortgage Interest Deduction

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Start Learning From Best Platform I Online Programs For Professionals Wagons

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Start Learning From Best Platform I Online Programs For Professionals Wagons

Free 34 Loan Agreement Forms In Pdf Ms Word

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

Best Real Estate Tax Tips

The Home Mortgage Interest Deduction Lendingtree

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Gentrification And The Affordable Housing Crisis The Responsible Consumer

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service